Basic Concepts of Macroeconomics - Revision Notes

CBSE Class–12 economics

Revision Notes

Macro Economics 05

National Income and Related Aggregate

Goods :In economics a goods is defined as any physical object, manmade, that could command a price in the market and these are the materials that satisfy human wants and provide utility

Consumption Goods : Those final goods which satisfy human wants directly. ex- ice-cream and milk used by the households.

Capital Goods :Those final goods which help in production. These goods are used for generating income. These goods are fixed assets of the producers.ex- plant and machinery.

Final Goods are those goods which are used either for final consumption or for investment.

Intermediate Goods refers to those goods and services which are used as a raw material for further production or for resale in the same year.

These goods do not fulfill needs of mankind directly.

Investment :Addition made to the physical stock of capital during a period of time is called investment. It is also called capital formation.

capital formation:- Change in the stock of capital is also called capital formation.

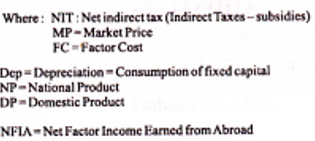

Depreciation :means fall in value of fixed capital goods due to normal wear and tear and expected obsolescence. It is also called consumption of fixed capital.

Gross Investment :Total addition made to physical stock of capital during a period of time. It includes depreciation. OR Net Investment + Depreciation

Net Investment :Net addition made to the real stock of capital during a period of time. It excludes depreciation.

Net Investment = Gross investment – Depreciation.

Stocks :Variables whose magnitude is measured at a particular point of time are called stock variables. Eg. National Wealth, Inventory etc.

Flows :Variables whose magnitude is measured over a period of time are called flow variable. Eg. National income, change in stock etc.

Circular flow of income :It refers to continuous flow of goods and services and money income among different sectors in the economy. It is circular in nature. It has neither any end and nor any beginning point. It helps to know the functioning of the economy.

Leakage :It is the amount of money which is withdrawn from circular flow of income. For eg. Taxes, Savings and Import. It reduces aggregate demand and the level of income.

Injection :It is the amount of money which is added to the circular flow of income. For e.g. Govt. Exp., investment and exports. It increases the aggregate demand and the level of income.

Economic Territory :Economic (or domestic) Territory is the geographical territory administrated by a Government within which persons, goods, and capital circulate freely.

Scope of Economic Territory :

(a) Political frontiers including territorial waters and airspace.

(b) Embassies, consulates, military bases etc. located abroad.

(c) Ships and aircraft operated by the residents between two or more countries.

(d) Fishing vessels, oil and natural gas rigs operated by residents in the international waters.

Normal Resident of a country: is a person or an institution who normally resides in a country and whose Centre of economic interest lies in that country.

Exceptions:- (a) Diplomats and officials of foreign embassy.

(b) Commercial travellers, tourists students etc.

(c) People working in international organizations like WHO, IMF, UNESCO etc. are treated as normal residents of the country to which they belong.

The related aggregates of national income are:-

(i) Gross Domestic Product at Market price (GDPMP)

(ii) Gross Domestic Product at Factor Cost (GDPFC)

(iii) Net Domestic Product at Market Price (NDPMP)

(iv) Net Domestic Product at FC or (NDPFC)

(v) Net National Product at FC or National Income (NNPFC)

(vi) Gross National Product at FC (GNPFC)

(vii) Net National. Product at MP (NNPMP)

(viii) Gross National Product at MP (GNPMP)

(i) Gross Domestic Product at Market Price : It is the money value of all the

final goods and services produced within the domestic territory of a country

during an accounting year.

GDPMP = Net domestic product at FC (NDPFC) + Depreciation + Net

Indirect tax.

(ii) Gross Domestic Product at FC : It is the value of all final goods and services

produced within domestic territory of a country which does not include net

indirect tax.

GDPFC = GDPMP – Indirect tax + Subsidy

or GDPFC = GDPMP – NIT

(iii) Net Domestic Product at Market Price : It is the money value of all final

goods and services produced within domestic territory of a country during an

accounting year and does not include depreciation.

NDPMP = GDPMP – Depreciation

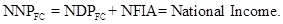

(iv) Net Domestic Product at FC : It is the value of all final goods and services

which does not include depreciation charges and net indirect tax. Thus it is

equal to the sum of all factor incomes (compensation of employees, rent,

interest, profit and mixed income of self employed) generated in the domestic

territory of the country.

NDPFC = GDPMP – Depreciation – Indirect tax + Subsidy

(v) Net National Product at FC (National Income) : It is the sum total of factor

incomes (compensation of employees + rent + interest + profit) earned by

normal residents of a country in an accounting year

or

NNPFC = NDPFC + Factor income earned by normal residents from abroad -

factor payments made to abroad.

(vi) Gross National Product at FC: It is the sum total of factor incomes earned

by normal residents of a country along with depreciation, during an accounting

year.

GNPFC = NNPFC + Depreciation OR

GNPFC = GDPFC + NFIA

(vii) Net National Product at MP : It is the sum total of factor incomes earned by

the normal residents of a country during an accounting year including net

indirect taxes.

NNPMP = NNPFC + Indirect tax – Subsidy

(viii) Gross National Product at MP : It is the sum total of factor incomes earned

by normal residents of a country during an accounting year including

depreciation and net indirect taxes.

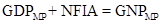

GNPMP = NNPFC + Dep + NIT

Domestic Aggregates

Gross domestic Product at Market Price  is the market value of all the final goods and services produced by all producing units located in the domestic territory of a country during an accounting year. It includes the value of depreciation or consumption of fixed capital.

is the market value of all the final goods and services produced by all producing units located in the domestic territory of a country during an accounting year. It includes the value of depreciation or consumption of fixed capital.

Net Domestic Product at Market Price Depreciation (consumption of Fixed capital). It is the market value of final goods and services produced within the domestic territory of the country during a year exclusive of depreciation.

Depreciation (consumption of Fixed capital). It is the market value of final goods and services produced within the domestic territory of the country during a year exclusive of depreciation.

It is the factor income accruing to owners of factors of production for suppling factor services with in domestic territory during an accounting year.

It is the factor income accruing to owners of factors of production for suppling factor services with in domestic territory during an accounting year.

NATIONAL AGGREGATES

Gross National Product at Market Price  ) is the market value of all the final goods and services produced by normal residents (in the domestic territory and abroad) of a country during an accounting year.

) is the market value of all the final goods and services produced by normal residents (in the domestic territory and abroad) of a country during an accounting year.

National Income  :It is the sum total of all factors incomes which are earned by normal residents of a country in the form of wages. rent, interest and profit during an accounting year.

:It is the sum total of all factors incomes which are earned by normal residents of a country in the form of wages. rent, interest and profit during an accounting year.

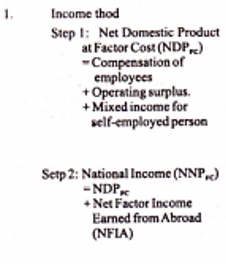

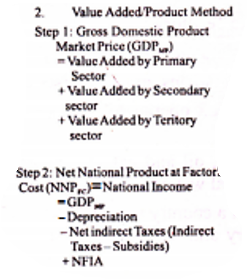

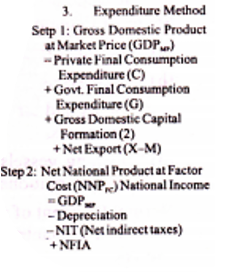

Methods of Estimation of National Income:

National Income at Current Prices : It is also called nominal National income. When goods and services produced by normal residents within and outside of a country in a year valued at current years prices i.e. current prices is called national income at current prices.

Y = Q x P

Y = National income at current prices

Q = Quantity of goods and services produced during an accounting year

P = Prices of goods and services prevailing during the current accounting year

National Income at Constant Prices :It is also called as real national income. When goods and services produced by normal residents within and outside of a country in a year valued at constant price i.e. base year's price is called National Income at Constant Prices.

Y' = Q x P'

Y' = National income at constant prices

Q = Quantity of goods and services produced during an accounting year

P' = Prices of goods and services prevailing during the base year

Value of Output :Market value of all goods and services produced by an enterprise during an accounting year.

Value added :It is the difference between value of output of a firm and value of inputs bought from the other firms during a particular period of time.

Problem of Double Counting :Counting the value of a commodity more than once while estimating national income is called double counting. It leads to overestimation of national income. So, it is called problem of double counting.

Ways to solve the problem of double counting.

(a) By taking the value of only final goods.

(b) By value added method.

Components of  Added by all 3 sectors

Added by all 3 sectors

1. Value Added by Primary Sector(=VO-IC)

2. Value Added by Secondary Sector(=VO-IC)

3. Value Added by Tertiary Sectors(=VO-IC)

Hints

VO=Value of output

IC=Intermediate Consumption

VO=Price X quantity OR

Sales + Change in stock

(Change in stock = Closing Stock - Opening Stock)

Components of Final Expenditure:

1. Final Consumption Expenditure

a. Private Final Consumption Expenditure(C)

b. Government Final Consumption Expenditure(G)

2. Gross Domestic Capital Formation

a. Gross Domestic Fixed Capital Formation

i. Gross business Fixed Investment

ii. Gross Residential Construction Investment

iii. Gross public Investment

b. Change in Stock or Inventory Investment

3. Net Export(X-M)

a. Export(X)

b. Import(M)