Admission of a Partner - Revision Notes

CBSE Class –12 Accountancy

Revision Notes

Chapter 4 Part – A

Accounting For Partnership Firms : Admission of A Partner

Meaning

When a new partner is admitted in a running business due to the requirement of more capital or may be to take advantage of the experience and competence the newly admitted partner or any other reason, it is called admission of a part in partnership firm.

According to section 31(1) of Indian partnership Act, 1932, “A new partner be admitted only with the consent of all the existing partners”

At the time of admission of new partner, following adjustments are requires

1. Calculation of new profit sharing ratio and sacrificing ratio.

2. Accounting treatment of Goodwill.

3. Accounting treatment of accumulated profit, reserves and accumulated loss.

4. Accounting treatment of revaluation of assets and reassessment of liabilities.

5. Adjustment of capital in new profit sharing ratio.

1. Calculation of new profit sharing ratio

Following types of problems may arise for the calculation of new profit share ratio.

Case (i) When old ratio is given and share of new partner is given.

Note : Unless agreed otherwise, it is presumed that the new partner acquires his share in profits from the old partners in their old profit sharing ratio.

Alternative Method :

Old Ratio = A : B

1 : 2

Left the profit of the firm = 1

C’s share (New Partner) = 1/3

Remaining Profit = 1-1/3 = 2/3

Now this profit 2/3 will be divided between the old partners in their future profit sharing ratio (old ratio) i.c., 1:2

A’s new Profit = 1/3 of 2/3 =  = 2/9

= 2/9

B’s new Profit = 2/3 of 2/3 =  = 4/9

= 4/9

C’s profit = 1/3 or  = 3/9

= 3/9

Hence the new ratio = 2:4:3

Note : In this case only New Partners share is given then Sacrificing ratio = Old

Ratio = 1 : 2 there is not need to calculate it

Case (ii) When new partner acquires his/her share from old partners in agreed share.

2. Accounting Treatment of Goodwill

At the time of admission of a partner, treatment of Goodwill is necessary to compensate the old partners for their sacrifice. The incoming partner must compensate the existing partners because he is going to acquire the right to share future profits and his share is sacrificed by old partners. If goodwill (Premium) is paid to old partners privately or outside the business by the new partner then on entry is required in the books of the firm.

There may be different situations about the treatment of goodwill at the time of the admission of the new partner.

(i) Goodwill (premium) brought in by the new partner in cash and retained in the business

Note : Sacrificing = Old ratio – New ratio

A = 3/5 – 3/8 =

B = 2/5 – 3/8 =

This sacrificing ratio between A and B i.e., 9 : 1.

3. Accounting treatment of Accumulated Profits

Accumulated profits and reserves are distributed to partners in their old profit sharing ratio. If old partners are not interested to distribute, these accumulated profits are adjusted in the same manner as goodwill and the following adjusting entry will be passed.

New Partner’s capital A/c Dr. (New share)

To old partner’s capital A/c (Sacrificing ratio)

4. Accounting treatment for revaluation of assets and re-assessment of liabilities

The assets and liabilities are generally revalued at the time of admission of a new partner. Revaluation Account is prepared for this purpose in the same way was in case of change in profit sharing ratio. This account is debited with all losses and credited with all gains. Balance of Revaluation Account is transferred to old partner in their old ratio.

5. Adjustment of Capital in New Profit Sharing Ratio

Working Notes :

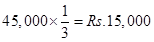

Gauri’s share of goodwill = Rs.

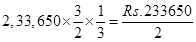

Total adjusted capital of old partner for 2/3 share = Rs. 1,42,433 + Rs. 91,217 = Rs. 2,33,650

Proportionate capital of Gauri 1/3 share = Rs.  = Rs. 1,16,855

= Rs. 1,16,855

Bank A/c

Particulars | (Rs.) | Particulars | (Rs.) |

To Gauri’s Capital To Premium for goodwill | 1,16,825 15,000 | By balance c/d | 1,31,825 |

1,31,825 | 1,31,825 |