Sources of Business Finance - Revision Notes

CBSE Class 11 Business Studies

Revision Notes

CHAPTER - 7

SOURCES OF BUSINESS FINANCE

CONCEPT OF BUSINESS FINANCE:

The term finance means money or fund. The requirements of funds by business to carry out its various activities is called business finance. Finance is needed at every stage in the life of a business. A business cannot function unless adequate funds are made available to it.

NEED OF BUSINESS FINANCE:

1. Fixed Capital Requirement: In order to start a business, funds are needed to purchase fixed assets like land and building, plant and machinery.The funds required in fixed assest remain invested in the business for a long period of time.

2. Working Capital Requirement: A business needs funds for its day to day operation. This is known as working Capital requirements. Working capital is required for purchase of raw materials, to pay salaries, wages, rent and taxes.

3. Diversification: A company needs more funds to diversify its operation to become a multi-product company e.g. ITC.

4. Technology upgradation: Finance is needed to adopt modern technology for example uses of computers in business.

5. Growth and expansion: Higher growth of a business enterprise requires higher investment in fixed assets. So finance is needed for growth and expansion.

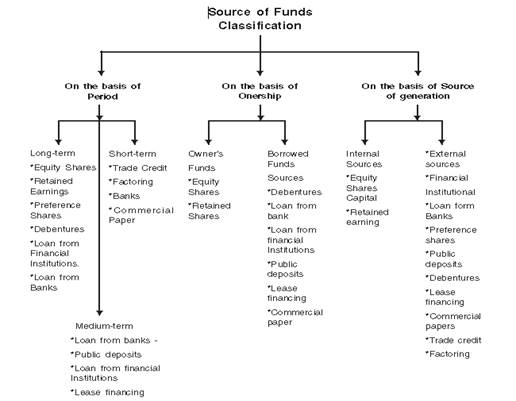

CLASSIFICATION OF SOURCE OF FUNDS

METHODS OF RAISING FINANCE:

Issue of Share: The capital obtained by issue of shares is known as share capital. The capital of a company is divided into small units called share. If acompany issue 10,000 shares of Rs. 10/- each then the share capital of company is 1,00,000. The person holding the share is known as shareholder. There are two types of share (I) Equity share (II) preference share.

(a) Equity Share: Equity shares represent the ownership of a company. They have right to vote and right to participate in the management.

ADVANTAGES/MERITS:

1. Permanent Capital: Equity share capital is important source of finance for a long term.

2. No charge on assets: For raising funds by issue of equity shares a company does not need to mortgage its assets.

3. Higher returns: Equity share holder get higher returns in the years of high profits.

4. Control: They have right to vote and right to participate in the management.

5. No burden on company: Payment of equity dividend is not compulsory.

LIMITATIONS/DEMERITS:

1. Risk: Equity shareholder bear higher risk because payment of equity dividend is not compulsory.

2. Higher Cost: Cost of equity shares is greater than the cost of preference share.

3. Delays: Issue of Equity shares is time consuming.

4. Issue depends on Share Market Conditions: Equity Shareholders are the primary risk bearer therefore the demand of equity shares is more in the boom time.

(b) Preference Share - Preference shares are considered safer in investment. (as compare to equity shares) They receive dividend at a fixed rate. Preference shareholder are like creditors. They have no voting right.

Types of preference shares:

1. Cumulative preference shares.

2. Non cumulative preference shares.

3. Participating preference shares.

4. Non participating preference shares.

5. Convertible preference shares.

6. Non Convertible preference shares.

MERITS OF PREFERENCE SHARES:

1. Investment is safe: Preference shareholders investment is safe. They have preferential right to claim dividend and capital.

2. No Charge on assets: The company does not need to mortgage its assets for issue of preference shares.

3. Control: It does not affect the control of equity share holders because they have no voting right.

4. Fixed dividend: They get fixed dividend. So, they are useful for those investor who want fixed rate of return.

LIMITATIONS /DEMERITS:

1. Costly sources of funds: Rate of preference dividend is greater than rate of interest on debenture, for a company it is costly source of funds than Debentures.

2. No tax saving: Preference dividend is not deductible from profit for income tax. Therefore, there is no tax saving.

3. Not suitable for risk takers - Preference shares are not suitable for those who are willing to take risk for higher return.

4. As dividend on these shares is to be paid only when the company earns profit, so investors may not be very attractive to these.

Difference between Equity Shares and Preference Shares

| Base | Equity Shares | Preference Shares |

1. | Dividend | After preference shares | Priority over equity share |

2. | Voting Right | Dividend is paid full voting rights. | No voting right. |

3. | Risk | Risk bearing securities | Less risk |

4. | Rate of Return | Fluctuates with profit | Fixed Rate of Dividend |

5. | Control | Control on the management. | No control on the management. |

Debentures: Debentures are the important debt sources of finance for raising long term finance. Debenture holders get fixed rate of interest on Debentures. Interest is paid after every six months or one year. They are like creditors of acompany.

Type of Debentures:

1. Secured Debentures

2. Unsecured Debentures

3. Convertible Debentures.

4. Non Convertible Debentures

5. Redeemable Debentures.

6. Registered Debentures.

MERITS OF DEBENTURES:

1. Investment is Safe: Debentures are preferred by those investor who do not want to take risk and interested in fixed income.

2. Control: Debenture holder do not have voting right. No control over the managment.

3. Less Costly: Debentures are less costly as compared to cost of preference shares.

4. Tax Saving: Interest on Debentures is a tax deductable expense. Therefore, there is a tax saving.

LIMITATION OF DEBENTURES:

1. Fixed Obligation: There is a greater risk when there is no earning because interest on debentures has to be paid if the company suffers losses.

2. Charge on assets: The company has to mortgage its assets to issue secured Debentures.

3. Reduction in Credibility: With the new issue of debentures, the company’s capability to further borrow funds reduces.

Difference between Shares and Debentures

| Base | Shares | Debentures |

1. | Nature | Shares are the capital | Debentures are a loan |

2. | Return | Dividend | Interest |

3. | Voting Right | Full voting right | No voting right |

4. | Holder | Owner is called shareholder. | Creditor |

5. | Types | There are two types of shares | More than two types |

6. | Security | Not secured by any charge | Secured and generally carry a charge on the assets of the company |

Retained Earnings: A portion of company’s net profit after tax and dividend, Which is not distributed but are retained for reinvestment purpose, is called retained earnings. This is also called sources of self-financing.

For example: X Ltd. has total capital of Rs. 50,00,000 which consists of 10% Debt of Rs.20,00,000, 8% preference share capital Rs. 10,00,000, and equity share capital Rs. 20,00,000. Tax rate is 40%, company’s return on total capital is 20%.

Particulars | Rs. |

Net profit before interest and tax (PBIT) (20% of Rs. 50,00,000) Less: Interest on debentures(10% of 20,00,000) | 10,00,000 2,00,000 |

Net profit before tax(PBT) Less: Tax provision @ 40% | 8,00,000 3,20,000 |

Net profit after Tax(PAT) Less: pre dividend(9% of 10,00,000) | 4,80,000 80,000 |

Net profit after tax and predividend Less: Equity Dividend | 4,00,000 2,00,000 |

Retained Earnings | 2,00,000 |

MERITS

1. No costs: No costs in the form of interest, dividend, advertisement and prospects, to be incurred by the company to get it.

2. No charges on assets: The company does not have to mortgage its assets.

3. Growth and expansion: Growth and expansion of business is possible by reinvesting the retained profits.

DEMERITS

1. Uncertain Source: It is uncertain source of fund because it is available only when profits are high.

2. Dissatisfaction among shareholder: Retained profits cause dissatisfaction among the shareholder because they get low dividend.

PUBLIC DEPOSITS: The deposits that are raised by company direct from the public are known as public deposits. The rate of interest offered on public deposits are higher than the rate of interest on bank deposits. This is regulated by the R.B.I. and cannot exceed 25% of share capital and reserves.

MERITS:

1. No charge on assets: The company does not have to mortgage its assets.

2. Tax Saving: Interest paid on public deposits is tax deductable, hence there is tax saving.

3. Simple procedure: The procedure for obtaining public deposits is simpler than share and Debenture.

4. Control: They do not have voting right therefore the control of the company is not diluted.

LIMITATIONS:

1. For Short Term Finance: The maturity period is short. The company cannot depend on them for long term.

2. Limited fund: The quantum of public deposit is limited because of legal restrictions 25% of share capital and free reserves.

3. Not Suitable for New Company: New company generally find difficulty to raise funds through public deposits.

COMMERCIAL BANKS: Commercial Banks give loan and advances to business in the form of cash credit, overdraft loans and discounting of Bill. Rate of interest on loan is fixed.

MERITS

1. Timely financial assistance: Commercial Bank provide timely financial assistance to business.

2. Secrecy: Secrecy is maintained about loan taken from a Commercial Banks.

3. Easier source of funds: This is the easier source of funds as there in no need to issue prospectus for raising funds.

LIMITATIONS/DEMERITS

1. Short or Medium term finance: Funds are not available for a long time.

2. Charge on assets: Required source security of assets before a loan is sanctioned.

FINANCIAL INSTITUTION:

The state and central government have established many financial institutions to provide finance to companies. They are called development Bank. These are IFCI, ICICI, IDBI, LIC and UTI. etc.

MERITS:

1. Long term Finance: Financial Institution provide long term finance which is not provided by Commercial Bank.

2. Managerial Advice: They provide financial, managerial and technical advice to business firm.

3. Easy installments: Loan can be made in easy installments. It does not prove to be much of a burden on business.

4. Easy availibility: The funds are made available even during periods of depression.

LIMITATIONS/ DEMERITS:

1. More time Consuming: The procedure for granting loan is time consuming due to rigid criteria and many formalities.

2. Restrictions: Financial Institution place restrictions on the company’s board of Directors.

INTERNATIONAL SOURCE OF BUSINESS FINANCE:

1. Commercial Bank: Commercial Bank provide foreign currency loan for business all-over the world. Standard chartered Bank is an important organization for foreign currency loan to the Indian industry.

2. International Agencies and Development Bank: A number of international agencies and development Bank e.g. IFC, ADB, provide long term loan.

3. INTERNATIONAL CAPITAL MERKET:

I. GDR: When the local currency shares of a company are delivered to the depository bank, which issues depository receipt against shares, these receipt denominated in US dollar are caller GDRs.

Feature of GDR:

1. GDR can be listed and traded on a stock exchange of any foreign country other than America.

2. It is negotiable instrument.

3. A holder of GDR can convert it into the shares.

4. Holder of GDR gets dividends.

5. Holder of GDR does not have voting rights.

6. Many Indian companies such as Reliance, Wipro and ICICI have issue GDR.

II. ADR: The depository receipt issued by a company in USA are known as ADRs (American Depository Receipts)

Feature of ADR:

1. It can be issued only to American Citizens.

2. It can be listed and traded is American stock exchange.

3. Indian companies such as Infosys, Reliance issued ADR

Difference between ADR and GDR

| Basis | ADR | GDR |

1. | Listing | Only in American Stock Exchange | Anywhere in the world less liquid |

2. | Liquidity | More liquid | Less Liquid |

3. | Share holder | Only American Citizens | All over the world citizens. |

III. Foreign Currency Convertable Bonds (FCCBs): The FCCB s are issued in a foreign currency and carry a fixed interest rate. These are listed and traded in foreign stock exchange and similar to the debenture.

Indian Depository Receipts (IDRS)

IDRs are like GDR or ADR except that the issuer is a foreign company raising funds from Indian Market. IDRS are rupee dominated. They can be listed on any Indian stock Exchange.

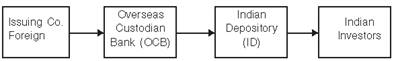

Issue Procedure of IDRS

1. Firstly, a Foreign Co. hands over the shares to OCB (it requires approval from Finance Ministry to act as a custodian)

2. The OCB request ID to issue shares in the form of IDR.

3. The ID converts the issue which are in foreign currency into IDR and into indian rupee.

4. Lastly the ID issues them to intending investors.

Features of IDRs

1. IDRs are issued by any foreign company

2. The IDRs can be listed on any Indian stock exchange.

3. A single IDR can represent more than one share, such as one IDR = 10shares.

4. The holders of IDR have no right to vote in the company.

5. The IDRS are in rupee denomination.

Advantages of IDR

1. It provides an additional investment opportunity to Indian Investors for overseas investment.

2. It satisfies the capital need of foreign companies.

3. It provides listing facility to foreign companies to list on Indian Equity Market.

4. It reduces the risk of Indian Investors who want to take their money abroad.

Inter-Corporate Deposits (ICD)

Inter-Corporate Deposits are unsecured short term deposits made by one company with another company. These deposits are essentially brokered deposited, which led the involvement of brokers. The rate of interest on their deposits is higher than that of banks and other markets. The biggest advantage of ICDS is that the transaction is free from legal hassles.

Type of lCDS

1. Three Months Deposits - These deposits are most popular type of ICDS.These deposits are generally considered by borrowers to solve problems of short term capital adequacy. The annual rate of interest for these deposits is around 12%.

2. Six months Deposits - It is usually made first class borrowers. The annual rate of interest for these deposits is around 15%

3. Call deposits - This deposit can be withdrawn by the lender on a day’s notice. The annual rate of interest on call deposits is around 10%

Features of ICDS

1. These transactions takes place between two companies.

2. There are short term deposits.

3. These are unsecured deposits.

4. These transactions are generally completed through brokers.

5. These deposits have no organized market.

6. These deposits have no legal formalities.

7. These are risky deposits from the point of view of lenders.