Business Services - Revision Notes

CBSE Class 11 Business Studies

Revision Notes

CHAPTER 4

BUSINESS SERVICES

It has already been stated that commerce consists of trade and auxiliaries to trade. Auxiliaries or aids to trade refer to the activities related to the buying and selling of goods and services. These auxiliaries to trade are also known as business services or facilities. These services are essential and indispensable for the smooth flow of trade and industry. The examples of business services are Banking, insurance, transport, Warehousing ,Advertisement and communication.

NATURE OF BUSINESS SERV1CES:

1. Intangibility: Cannot be seen, touched or smelled. Just can only be felt, yet their benefits can be availed of e.g. Treatment by doctor.

2. Inconsistency: Different customers have different demands & expectation.e.g. Mobile services/Beauty Parlour.

3. In Separability: Production and consumption are performed simultaneously .For e.g. ATM may replace clerk but presence of customer is must.

4. Inventory Loss: Services cannot be stored for future use or performed earlier to be consumed at a later date. e.g. underutilized capacity of hotels and airlines during slack demand cannot be stored for future when there will be a peak demand.

5. Involvement: Participation of the customer in the service delivery is a must e.g. A customer can get the service modified according to specific requirement.

Type of Services:

1. Social Services: Provided voluntarily to achieve certain goals e.g. healthcare and education services provided by NGOs.

2. Personal Services: Services which are experienced differently by different customers. e.g. tourism, restaurants etc.

3. Business Services: Services used by business enterprises to conduct their activities smoothly. e.g. Banking, Insurance, communication, Warehousing and transportation.

Banks

Banks occupy an important position in the modern business World. No country can make commercial and industrial progress without a well organized banking system. Banks encourage the habit of saving among the public. They mobilize small savings and channelize them into productive uses.

Meaning of Bank

A bank is an institution which deals in money and credit. It collects deposits from the public and supplies credit, thereby facilitating exchange. It also performs many other functions like credit creation, agency functions, general services etc Hence ,a Bank is an organization which accepts deposits, lends money and perform other agency functions.

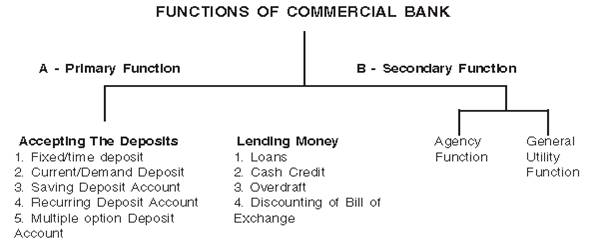

Primary Functions

1. Accepting Deposits: Accepting deposits is the main function of commercial banks. Banks offer different types of Bank accounts to suit the requirements and needs of different customers. Different types of Bank accounts areas follows:

A. Fixed Deposit Account: Money is deposited in the account for a fixed period is called as Fixed Deposit account. After expiry of specified period ,person can claim his money from the bank. Usually the rate of interest is maximum in this account. The longer the period of deposit, the higher will be the rate of interest on deposit.

B. Current Deposit Account: Current deposit Accounts are opened by businessman. The account holder can deposit and Withdraw money. Whenever desired. As the deposit is repayable on demand, it is also known as demand deposit. Withdrawals are always made by cheque. No interest is paid on current accounts. Rather charges are taken by bank for services rendered by it.

C.Saving Deposit Account: The aim of a saving account is to mobilize savings of the public. A person can open this account by depositing a small sum of money. He can withdraw money from his account and make additional deposits at will. Account holder also gets interest on his deposit. In this account though the rate of interest is lower than the rate of interest on fixed deposit account.

D.Recurring Deposit Account: The aim of recurring deposit is to encourage regular savings by the people. A depositor can deposit a fixed amount, say Rs. 100 every month for a fixed period. The amount together with interest is repaid on maturity. The interest rate on this account is higher than that on saving deposits.

E. Multiple Option Deposit Account: It is a type of saving Bank A/c in which deposit in excess of a particular limit get automatically transferred into fixed Deposit. On the other hand, in case adequate fund is not available in our saving Bank Account so, as to honour a cheque that we have issued the required amount gets automatically transferred from fixed deposit to the saving bank account. Therefore, the account holder has twin benefits from this amount (i) he can earn more interest and (ii) It lowers the risk of dishonoring a cheque.

2. Lending Money with the help of money collected through various types of deposits, commercial banks lend finance to businessman, farmers, and others. The main ways of lending money are as follows:

A. Term Loans: These loans are provided by the banks to their customers for a fixed period to purchases Machinery. Truck. Scooter. House etc. The borrowers repay the loans in Monthly/Quarterly/Half Yearly/Annual installments.

B. Bank Overdraft: The customer who maintains a current account with the bank, takes permission from the bank to withdraw more money than deposited in his account. The extra amount withdrawn is called overdraft. This facility is available to trustworthy customers for a small period. This facility is usually given against the security of some assets or on the personal security of the customer. Interest is charged on the actual amount overdrawn by the customer.

C. Cash Credit: Under this arrangement, the bank advances cash loan up to a specified limit against current assets and other securities. The bank opens an account in the name of the borrower and allows him to withdraw the borrowed money from time to time subject to the sanctioned limit. Interest is charged on the amount actually withdraw.

D. Discounting of Bill of Exchange: Under this, a bank gives money to its customers on the security of a bill of exchange before the expiry of the bill in ease of customers needs it. For this service bank charges discount for the remaining period of the bill.

Secondary Functions

The secondary functions of commercial banks are as under:

(1) Agent Functions

As an agent of its customers a commercial bank provides the following services:

(I) Collecting bills of exchange, promissory notes and cheques.

(II) Collecting dividends, interest etc.

(III) Buying and selling shares, debentures and other securities.

(IV) Payment of interest, insurance premium etc.

(V) Transferring funds from one branch to another and from one place to another.

(VI) Acting as an agent of representative while dealing with other banks and financial institutions. A Commercial banks performs the above functions on behalf of and as per the instructions of its customers.

(2) General Utility Functions:

Commercial banks also perform the following miscellaneous functions:

(I) Providing lockers for safe custody of jewellery and other valuables of customers.

(II) Giving references about the financial position of customers.

(III) Providing information to a customer about the credit worthiness of other customers.

(IV) Supplying various types of trade information useful to customer.

(V) Issuing letter of credit, pay orders, bank draft, credit cards and travelers cheques to customers.

(VI) Underwriting issues of shares and debentures.

(VII) Providing foreign exchange to importers and travellers going abroad.

Bank Draft: It is a financial instrument with the help of which money can be remitted from one place to another. Anyone can obtain a bank draft after depositing the amount in the bank. The bank issues a draft for the amount in its own branch at other places or other banks (only in case of tie up with those banks) on those places. The payee can present the draft on the drawee bank at his place and collect the money. Bank charges some commission for issuing a bank draft.

Banker's cheque or Pay Order: It is almost like a bank draft. It refers to that bank draft which is payable within the town. In other words banks issue pay order for local purpose and issue bank draft for outstation transactions.

ELECTRONIC BANKING SERVICES/E-BANKING

Use of computers and internet in the functioning of the banks is called electronic banking. Because of these services the customers don't need to go to the bank every time for every transaction. He can make transactions with the bank at any time and from any place. The chief electronic services are the following:

1. Electronic. Fund Transfer: Under it, a bank transfers wages and salaries directly from the company s account to the accounts of employees of the company. The other examples of EFTs are online payment of electricity bill, water bill, insurance premium, house tax etc.

2. Automatic Teller Machines: (ATMs) ATM is an automatic machine with the help of which money can be withdrawn or deposited by inserting the card and entering personal Identity Number (PIN). This machine operates for all the 24 hours.

3. Debit Card: A Debit Card is issued to customers in lieu of his money deposited in the bank. The customers can make immediate payment of goods purchased or services obtained on the basis of his debit card provided the terminal facility is available with the seller.

4. Credit Card: A. bank issues a credit card to those of its customers who enjoy good reputation. This is a sort of overdraft facility. With the help of this card ,the holder can buy goods or obtain services up to a certain amount even without having sufficient deposit in their bank accounts.

5. Tele Banking: Under this facility, a customer can get information about the account balance or any other information about the latest transactions on the telephone.

6. Core Banking Solution Centralized Banking Solution: In this system customer by opening a bank account in one branch (which has CBS facility) can operate the same account in all CBS branches of the same bank anywhere across the country. It is immaterial with which branch of the bank the customer deals with when he/she is a CBS branch customer.

7. National Electronic Fund Transfer: NEFT refers to a nationwide system that facilitate individuals, firms and companies to electronically transfer funds from any branch to any individual, firm or company having an account with any other bank branch in the country. NEFT settles transactions in batches. The settlement takes place at a particular point of time for example, NEFT settlement takes place 6 times a day during the week days (9.30am, 10.30 am, 12.00 noon, 1.00 pm. 3.00 pm & 4.00pm) and 3 times during Saturday 9.30 am, 10.30 am and 12.00 noon) Any transaction initiated after a designated settlement time is settled on the next fixed settlement time.

8. Real Time Gross Settlement: RTGS refers to a funds transfer system where transfer of funds takes place from one bank to another on a Real-time and on Gross basis. Settlement in Real time means transactions are settled as soon as they are processed and are not subject to any waiting period. Gross settlement means the transaction is settled on one to one basis without bunching or netting with any other transaction. This is the fastest possible money transfer system through the banking channel. The RTGS service for customers is available from 9.00 am to 3.00 pm on weekdays and from 9.00 am to 12.00 noon on Saturdays. The basic difference between RTGS and NEFT is that while RTGS transactions are processed continuously, NEFT settles transactions in batches.

Benefits of E-Banking to customer:

1. E-Banking provides 24 hours a day X 365 days a year services to the customers.

2. Customers can make transactions from office or house or while traveling via mobile telephone.

3. There is greater customer satisfactions through E-banking as it offers unlimited access and great security as they can avoid travelling with cash.

Benefits of E-Banking to Banks:

1. E-Banking lowers the transaction cost.

2. Load on branches can be reduced by establishing centralized data base.

3. E-Banking provides competitive advantage to the bank, adds value to the banking relationship.

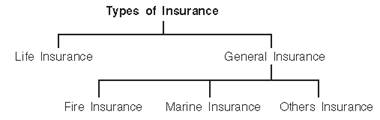

Meaning of insurance:

Insurance is a contract under which one party (Insureror Insurance Company) agrees in return of a consideration (Insurance premium) to pay an agreed sum of money to another party (Insured) to make good for a loss, damage or injury to something of value in which the insured has financial interest as a result of some uncertain event.

Principles of Insurance: These principles are :

1. Utmost Good Faith: Insurance contracts are based upon mutual trust and confidence between the insurer and the insured. It is a condition of every insurance contract that both the parties i.e.insurer and the insured must disclose every material fact and information related to insurance contract to each other.

2. Insurable Interest: It means some pecuniary interest in the subject matter of insurance contract. The insured must have insurable interest in the subject matter of insurance i.e., life or property insured the insured will have to incur loss due to this damage and insured will be benefitted if full security is being provided. A businessman has insurable interest in his house, stock, his own life and that of his wife, children etc.

3. Indemnity: Principle of indemnity applies to all contracts except the contract of life insurance because estimation regarding loss of life cannot be made. The objective of contract of insurance is to compensate to the insured for the actual loss he has incurred. These contracts ‘provide security from loss and no profit can be made out of these contracts.

4. Proximate Cause: The insurance company will compensate for the loss incurred by the insured due to reasons mentioned in insurance policy. But if losses are incurred due to reasons not mentioned in insurance policy than principle of proximate cause or the nearest cause is followed.

5. Subrogation: This principle applies to all insurance contracts which are contracts of indemnity. As per this principle, when any insurance company compensates the insured for loss of any of his property, then all rights related to that property automatically gets transferred to insurance company.

6. Contribution: According to this principle if a person has taken more than one insurance policy for the same risk then all the insurers will contribute the amount of loss in proportion to the amount assured by each of them and compensate for the actual amount of loss because he has no right to recover more than the full amount of his actual loss.

7. Mitigation: According to this principle the insured must take reasonable steps to minimize the loss or damage to the insured property otherwise the claim from the insurance company may be lost.

Concept of Life Insurance:

Under life insurance the amount of Insurance is paid on the maturity of policy or the death of policy holder whichever is earlier. If the policy holder survives till maturity he enjoys the amount of insurance. If he dies before maturity then the insurance claim helps in maintenance of his family. The insurance company insures the life of a person in exchange for a premium which may be paid in one lump sum or periodically say yearly, half yearly quarterly or monthly.

Types of Life Insurance Policies:

1. Whole Life Policy: Under this policy the sum insured is not payable earlier than death of the insured. The sum becomes payable to the heir of the deceased.

2. Endowment Life Insurance Policy: Under this policy the insures undertakes to pay the assured to his heirs or nominees a specified summon the attainment of a particular age or on his death whichever is earlier.

3. Joint Life Policy: It involves the insurance of two or more lives simultaneously. The policy money is payable on the death of any one olives assured and the assured sum will be payable to the survivor or survivors.

4. Annuity Policy: This policy is one under which amount is payable in monthly, quarterly, half yearly or annual installments after the assured attains a certain age. This is useful to those who prefer a regular income after a certain age.

5. Children’s Endowment Policy: This policy is taken for the purpose of education of children or to meet marriage expenses. The insurer agrees to pay a assured sum when the child attains a certain age.

Fire Insurance: It provides safety against loss from fire. If property of insured gets damaged due to property as compensation from insurance company. If no such event happens,then no claim shall be given.

Features:

1. Utmost Good Faith

2. Contract of Indemnity

3. Insurable Interest in Subject matter.

4. Subject to the doctrine of causa proxima.

5. It is a contract for an year. It generally comes to an end at the expiry of the year and may be renewed.

Marine Insurance: Marine Insurance provides protection against loss during sea voyage. The businessmen can get his ship insured by paying the premium fixed by the insurance company. The functional principles of marine insurance are the same as the general principles of Insurance.

OTHER INSURANCE

Health Insurance: With a lot of awareness today,Health insurance has gained a lot of popularity. General Insurance companies provide special health insurance policies such as Mediclaim for the general public. The insurance company charges a nominal premium every year and in return undertakes to provide up to stipulated amount for the treatment of certain diseases such as heart problem, cancer, etc.

Communication: In this fast moving and competitive world it is essential to have advanced technology for quick exchange of information with the help of electronic media. It is an important service that helps in establishing links between businessmen. Organization, suppliers, customers etc. It educates people, widen their knowledge and broaden their outlook. It overcomes the problem of distance between people, businessmen and institutions and thus,it helps in smooth running of business activities. The main services can be classified into postal and telecom.

Postal Services: This service is required by every business to send and receive letters, market reports, parcel, money order etc.on regular. All these services are provided by the post and telegraph offices scattered throughout the country. The postal department performs the following services.

1. Financial Services :They provide postal banking facilities to the general public and mobilize their savings through the following saving schemes like public provident fund (PPF), KisanVikasPatra, National Saving Certificate, Recurring Deposit Scheme and Money Order facility.

2. Mail Services :The mail services offered by post offices includes transmission of messages through post cards, Inland letters, envelops etc. The various mail services all:

1. UPC (under postal certificate): When ordinary letters are posted the post office does not issue any receipt. However, if sender wants to have proof then a certificate can be obtained from the post office on payment of prescribed fee. This paper now serves as a evidence of posting the letters.

2. Registered Post: Sometimes we want to ensure that our mail is definitely delivered to the addressee otherwise it should come back to us. In such situations the post office offers registered post facility which serves as a proof that mail has been posed.

3. Parcel: Transmission of articles from one place to another in the form of parcels is known as parcel post. Postal charges vary according to the weight of the parcels.

Allied Postal Services

1. Greetings Post: Greetings can be sent through post offices to people at different places.

2. Media Post: Cooperates can advertise their brands through post cards, envelops etc.

3. Speed Post: It allows speedy transmission of articles (within 24 hours) to people in specified cities.

4. e-bill post: The post offices collect payment of bills on behalf of BSNL and other organizations.

5. Courier Services: Letters, documents, parcels etc. can be sent through the courier service. It being a private service the employees work with more responsibility.

Telecom Services: Today’s global business world, the dream of doing business across the world, will remain a dream only in the absence of telecom services. The various types of telecom services are

1. Cellular mobile services: cordless mobile communication device including voice and non-voice messages, data services and PCO services.

2. Radio Paging Services means of transmitting information to persons even when they are mobile.

3. Fixed Line Services includes voice and non-voice messages and data services to establish linkage for long distance traffic.

4. Cable services Linkages and switched services within a licensed area of operation to operate media services which are essentially oneway entertainment related services.

5. VSAT Service (Very small Aperture Terminal) is a Satellite based communication service. It offers government and business agencies a highly flexible and reliable communication solution in both urban and rural areas.

6. DTH Services (Direct to Home) a Satellite based media services provided by cellular companies with the help of small dish antenna and a setup box.

Tranportation: Transportation comprises freight services together with supporting and auxiliary services by all the modes of transportation i.e rail, road, air and sea for the movement of goods and international carriage of passengers.

Warehousing: The warehouse was initially viewed as a static unit for keeping and storing goods in a scientific and systematic manner so as to maintain their original quality, value and usefulness.